For Week Ending October 28, 2023

For Week Ending October 28, 2023

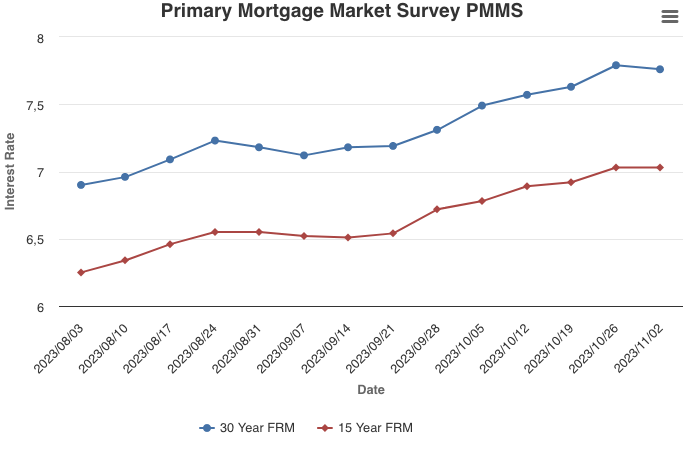

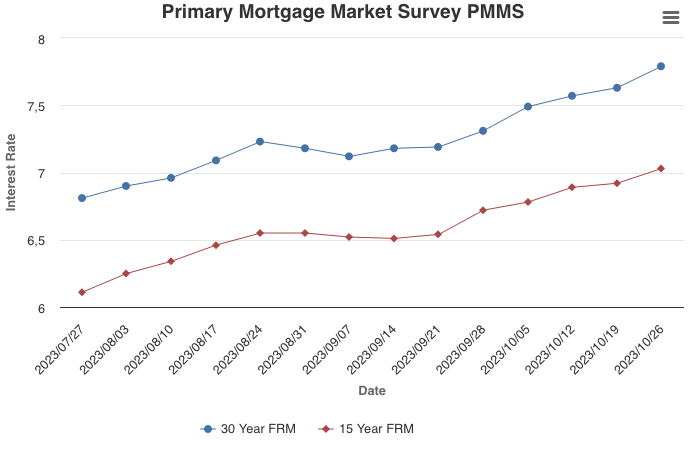

Elevated mortgage rates have surpassed high home prices as the primary barrier to housing affordability, according to Fannie Mae’s latest Home Price Sentiment Index (HPSI), which fell by 2.4 points to 64.5 in September. The monthly decrease in HPSI was attributed to net decreases in 5 of the Index’s 6 components—Buying Conditions, Selling Conditions, Mortgage Rate Outlook, Job Loss Concern, and Change in Household Income—with the majority of consumers reporting that they expect mortgage rates will continue to rise over the next 12 months.

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING OCTOBER 28:

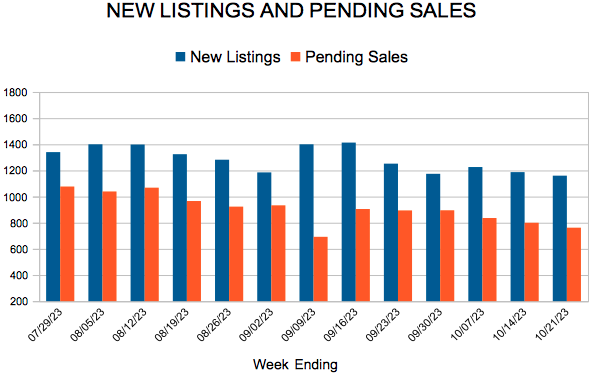

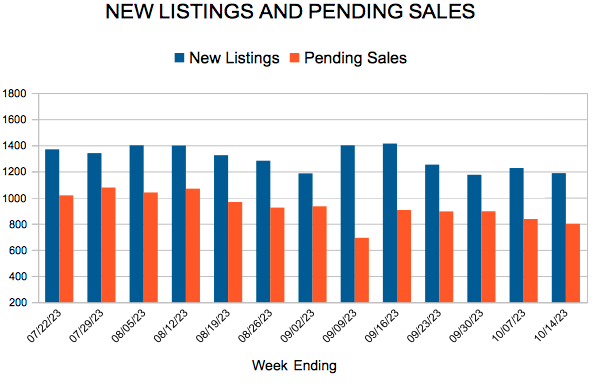

- New Listings decreased 9.1% to 986

- Pending Sales decreased 13.2% to 696

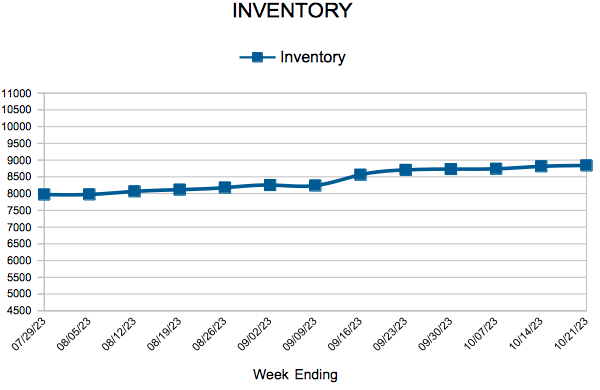

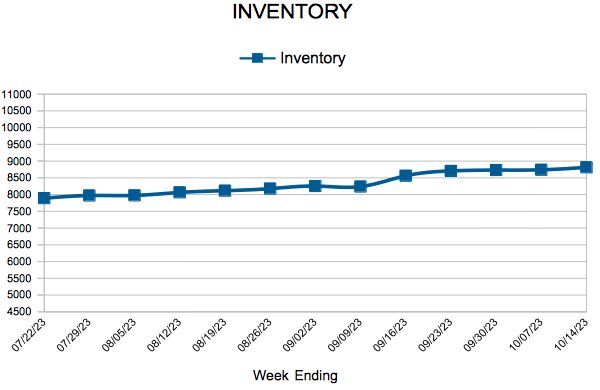

- Inventory decreased 6.3% to 8,893

FOR THE MONTH OF SEPTEMBER:

- Median Sales Price increased 2.4% to $371,000

- Days on Market increased 6.3% to 34

- Percent of Original List Price Received increased 0.4% to 99.3%

- Months Supply of Homes For Sale increased 20.0% to 2.4

All comparisons are to 2022

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.