Prices on the rise again after flattening out; seller activity may be stabilizing

- The median sales price increased 2.7 percent to $389,900

- Signed purchase agreements fell 10.5 percent; new listings down 2.8 percent

- Sellers still getting strong offers at 100.0 percent of their list price

(September 15, 2023) – According to new data from Minneapolis Area REALTORS® and the Saint Paul Area Association of REALTORS®, home prices rose modestly in August. Both buyer and seller activity were lower compared to last year.

Sales & Prices

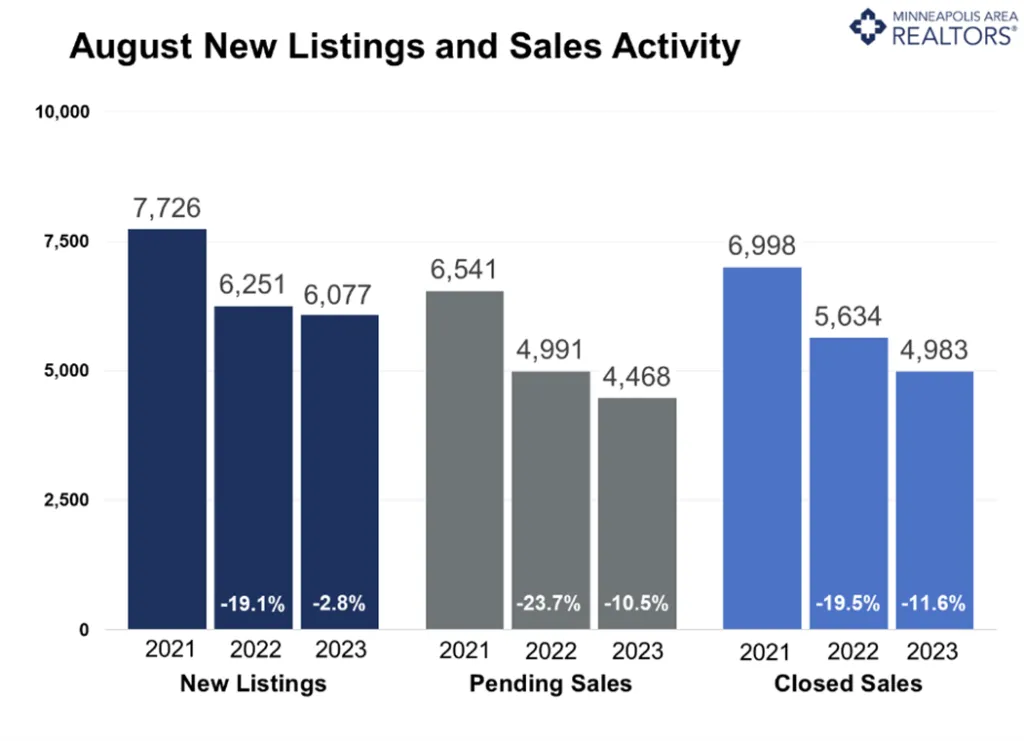

Pending home sales—or listings with accepted offers—were down 10.5 percent compared to last August. While those declines have moderated, it’s mostly due to comparing to a lower baseline last year as sales were slowing due to rising interest rates causing affordability challenges. Closed sales fell 11.6 percent overall, but townhomes had the smallest decline of any property type while new home sales rose an impressive 33.2 percent. Existing homeowners are choosing to stay put instead of trading up for a substantially higher monthly payment driven by rising prices and mortgage rates. That means builders listing new homes are benefiting from a shift in demand to new construction.

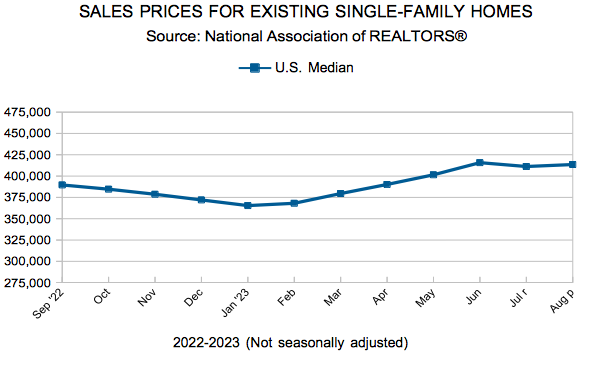

Home prices were down slightly in April and May, up slightly in June, and flat in July. The August median home price was up 2.7 percent from August 2022, up 20.0 percent from August 2021 and up 32.3 percent from August 2020. It’s not clear whether softening prices will continue, that depends on rates and demand. Of the homeowners who did sell their properties, they received an average of 100.0 percent of list price after 32 days on market. Market times were up 18.5 percent from last year, yet homes are still selling faster than in August of 2018 and 2019 and the same pace as 2020. “Not to oversimplify, but prices are rising because we still have a decent number of buyers competing for an insufficient number of homes,“ said Brianne Lawrence, President of the Saint Paul Area Association of REALTORS®. “Sellers of existing homes staying put forces some buyers to look at new homes or consider other more affordable property types such as townhomes, although affordability does vary within that segment.”

Listings and Inventory

In August, sellers listed only 2.8 percent fewer homes than last year, which is the smallest decline since May 2022 and a possible sign some existing supply could start to loosen up. Part of that is also due to a low baseline level. Inventory levels still slid 11.8 percent as of the most recent data. Sellers who locked in low interest rates are reluctant to give them up. “There’s always a certain level of activity in the market because of family changes, economic reasons or relocations to name a few,” said Jerry Moscowitz, President of Minneapolis Area REALTORS®. “But some less motivated buyers without that urgency are looking more cautiously at budgets and monthly payments.”

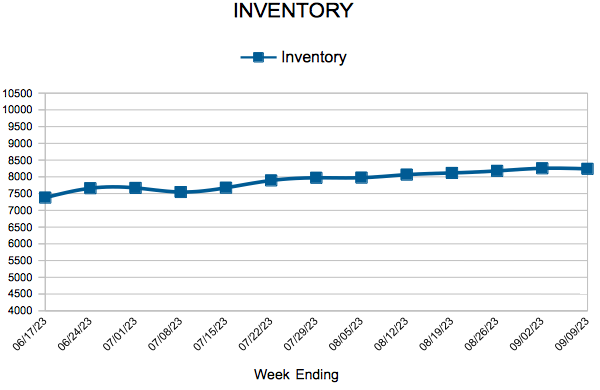

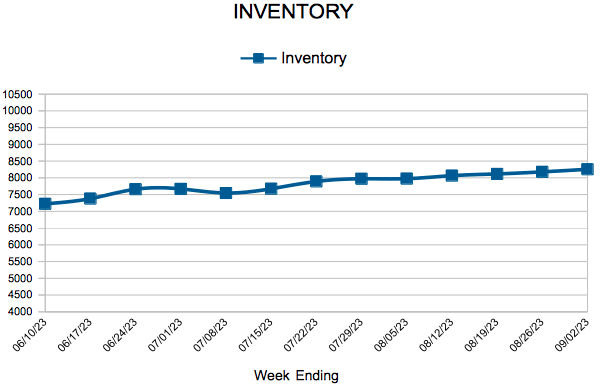

The balance between buyers and sellers has remained tight because both sales and listings have come down together. There were just over 8,000 active listings at the end of August; that needs to be closer to 20,000 to have a balanced market. At a still-low 2.2 months supply of inventory, buyers don’t have the upper hand some thought they would. Typically 4-6 months of supply are needed to reach a balanced market.

Location & Property Type

Market activity varies by area, price point and property type. New home sales rose 21.1 percent while existing home sales fell 13.9 percent. Single family sales were down 13.5 percent, condo sales decreased 9.0 percent and townhome sales were down just 3.2 percent. Sales in Minneapolis declined 17.0 percent while Saint Paul sales fell 11.5 percent. Cities such as Rogers, Otsego, Medina and Victoria saw the largest sales gains while Red Wing, East Bethel and Columbia Heights all had notably lower demand than last year.

For more information on weekly and monthly housing numbers visit www.mplsrealtor.com or www.spaar.com

August 2023 Housing Takeaways (compared to a year ago)

- Sellers listed 6,077 properties on the market, a 2.8 percent decrease from last August

- Buyers signed 4,468 purchase agreements, down 10.5 percent (4,983 closed sales, down 11.6 percent)

- Inventory levels shrank 11.8 percent to 8,111 units

- Month’s Supply of Inventory rose 15.8 percent to 2.2 months (4-6 months is balanced)

- The Median Sales Price was up 2.7 percent to $389,900

- Days on Market rose 18.5 percent to 32 days, on average (median of 15 days, unchanged from last year)

- Changes in Sales activity varied by market segment

- Single family sales decreased 13.5 percent; condo sales were down 9.0 percent; townhouse sales fell 3.2 percent

- Traditional sales declined 11.9 percent; foreclosure sales rose 178.9 percent to 53; short sales were flat at 7

- Previously owned sales were down 13.9 percent; new construction sales increased 21.1 percent

- Sales under $500,000 fell 13.6 percent; sales over $500,000 were down 4.3 percent

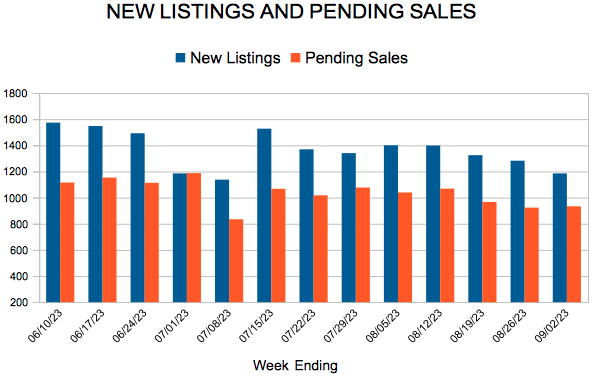

New Listings and Pending Sales

Inventory

Weekly Market Report

For Week Ending September 9, 2023

For Week Ending September 9, 2023

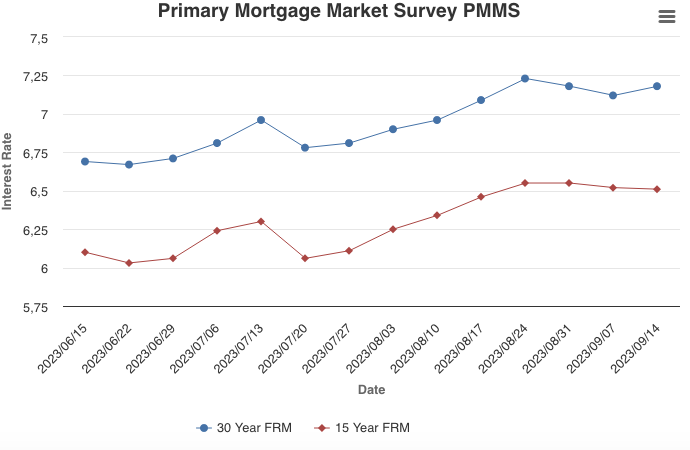

Mortgage applications fell to their lowest level since 1996, with total mortgage applications dropping 0.8% from the previous week, according to the Mortgage Bankers Association (MBA), as higher mortgage interest rates continue to take their toll on market participants. Applications to purchase a home were 27% lower than the same week a year ago, while demand for refinances was down 31% compared to the same week last year.

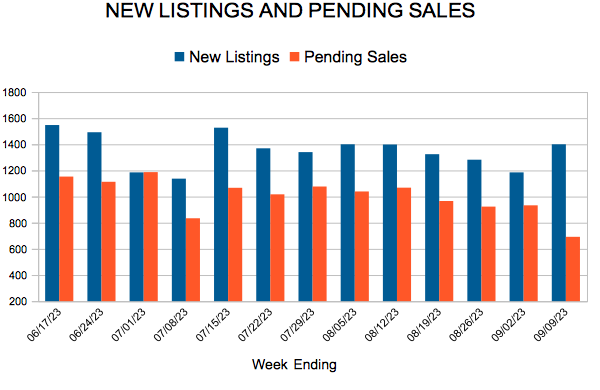

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING SEPTEMBER 9:

- New Listings decreased 2.4% to 1,400

- Pending Sales decreased 16.7% to 692

- Inventory decreased 10.3% to 8,239

FOR THE MONTH OF AUGUST:

- Median Sales Price increased 2.7% to $380,000

- Days on Market increased 18.5% to 32

- Percent of Original List Price Received increased 0.1% to 100.0%

- Months Supply of Homes For Sale increased 15.8% to 2.2

All comparisons are to 2022

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

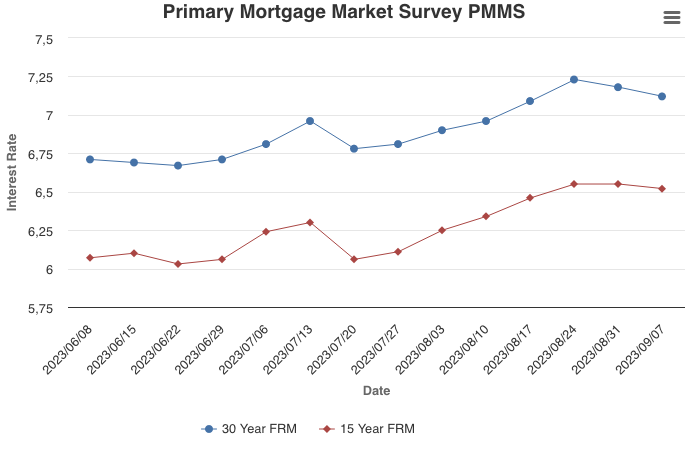

Mortgage Rates Inch Back Up

September 14, 2023

Mortgage rates inched back up this week and remain anchored north of seven percent. The reacceleration of inflation and strength in the economy is keeping mortgage rates elevated. However, potential homebuyers can still benefit during these times of high mortgage rates by shopping around for the best rate quote. Freddie Mac research suggests homebuyers can potentially save $600-$1,200 annually by applying for mortgages from multiple lenders.

Information provided by Freddie Mac.

New Listings and Pending Sales

Inventory

Weekly Market Report

For Week Ending September 2, 2023

For Week Ending September 2, 2023

The lack of existing-home inventory continues to boost demand for new construction homes, and U.S. homebuilders are ramping up production to help meet buyers’ needs. According to the U.S. Census Bureau, total housing starts rose 3.9% month-over-month to a seasonally adjusted rate of 1.452 million, and were up 5.9% from the same period last year, exceeding economists’ expectations. Much of the increase was due to single-family starts, which grew 6.7% month-over-month, led by gains in the Midwest and West regions.

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING SEPTEMBER 2:

- New Listings decreased 2.1% to 1,185

- Pending Sales decreased 6.1% to 933

- Inventory decreased 11.3% to 8,255

FOR THE MONTH OF JULY:

- Median Sales Price remained flat at $375,000

- Days on Market increased 31.8% to 29

- Percent of Original List Price Received decreased 0.7% to 100.8%

- Months Supply of Homes For Sale increased 15.8% to 2.2

All comparisons are to 2022

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

Mortgage Rates Decrease from Last Week While Remaining Above Seven Percent

September 7, 2023

For the fourth consecutive week, the 30-year fixed-rate mortgage hovered above seven percent. The economy remains buoyant, which is encouraging for consumers. Though while inflation has decelerated, firmer economic data have put upward pressure on mortgage rates which, in the face of affordability challenges, are straining potential homebuyers.

Information provided by Freddie Mac.

- « Previous Page

- 1

- …

- 43

- 44

- 45

- 46

- 47

- …

- 67

- Next Page »